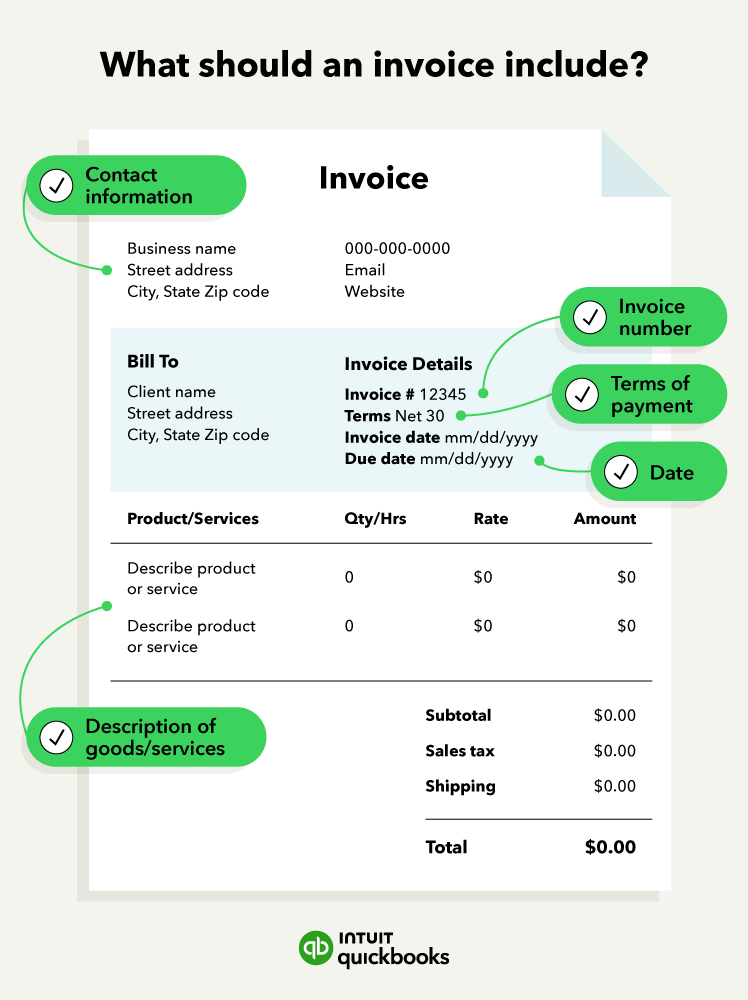

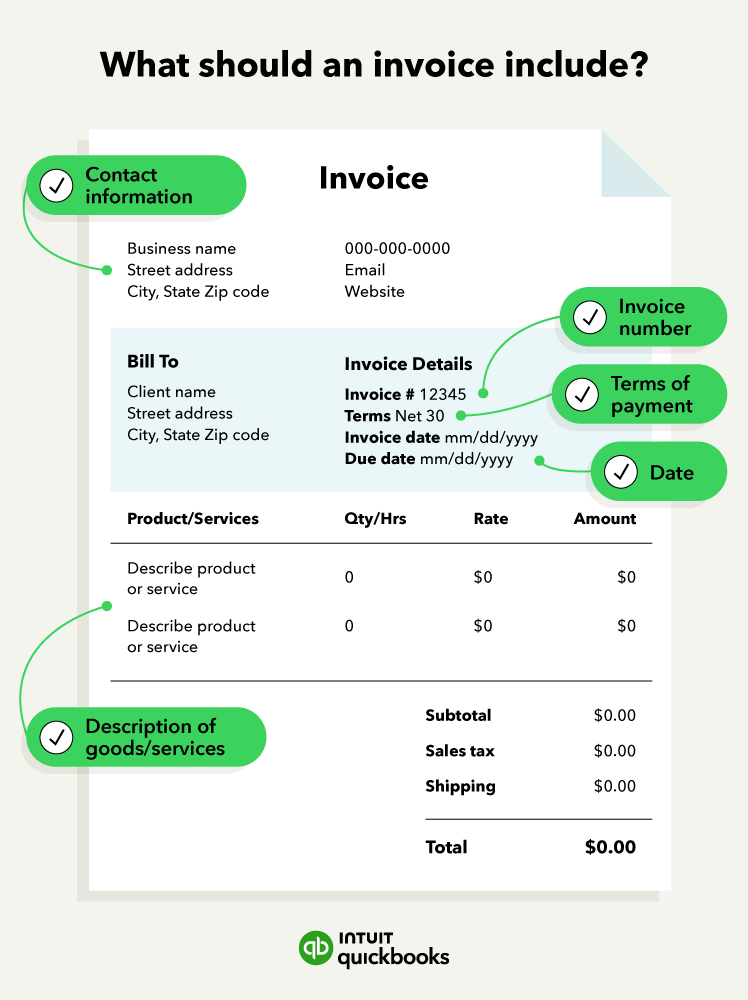

An invoice number should be assigned to each invoice you issue. This reference number establishes a paper trail of information for you and your customers’ accounting records. Assign invoice numbers sequentially so that the number on each new invoice is higher than the last.

Invoices aren’t necessarily due immediately when customers receive them. You may set invoice payment terms of up to three months to give your customers the flexibility to manage their cash. No matter what your payment terms are, express them clearly to your customer to ensure all parties are on the same page.

The invoice date indicates the time and date the vendor officially records the transaction and bills the client. The invoice date is crucial as it dictates the payment due date and credit duration. Generally, the due date is 30 days following the invoice date, but this can vary based on a company’s needs and the agreement with the client or buyer.

Invoices should also include a payment due date to indicate when the business expects to be paid. This date is usually 30 days after the invoice date.

Within an invoice, you must provide your business contact information, including name, address, phone number, and email address, along with your client or buyer’s information.

Make sure you address your invoice to the correct person. Verifying their information can prevent costly errors and increase your chances of receiving timely payment. Include the customer’s contact information on your invoice, including their:

You should enter every product or service you provide as a line item on your invoices. Include price and quantity for each line item. At the bottom of the invoice, add up all of the line items, and apply any tax charges.

Here’s what to include when listing products or services provided:

Your invoice should also include other relevant information about the total cost, including:

New Businesses

You're never too small, and it's never too soon to know you're on track for success.

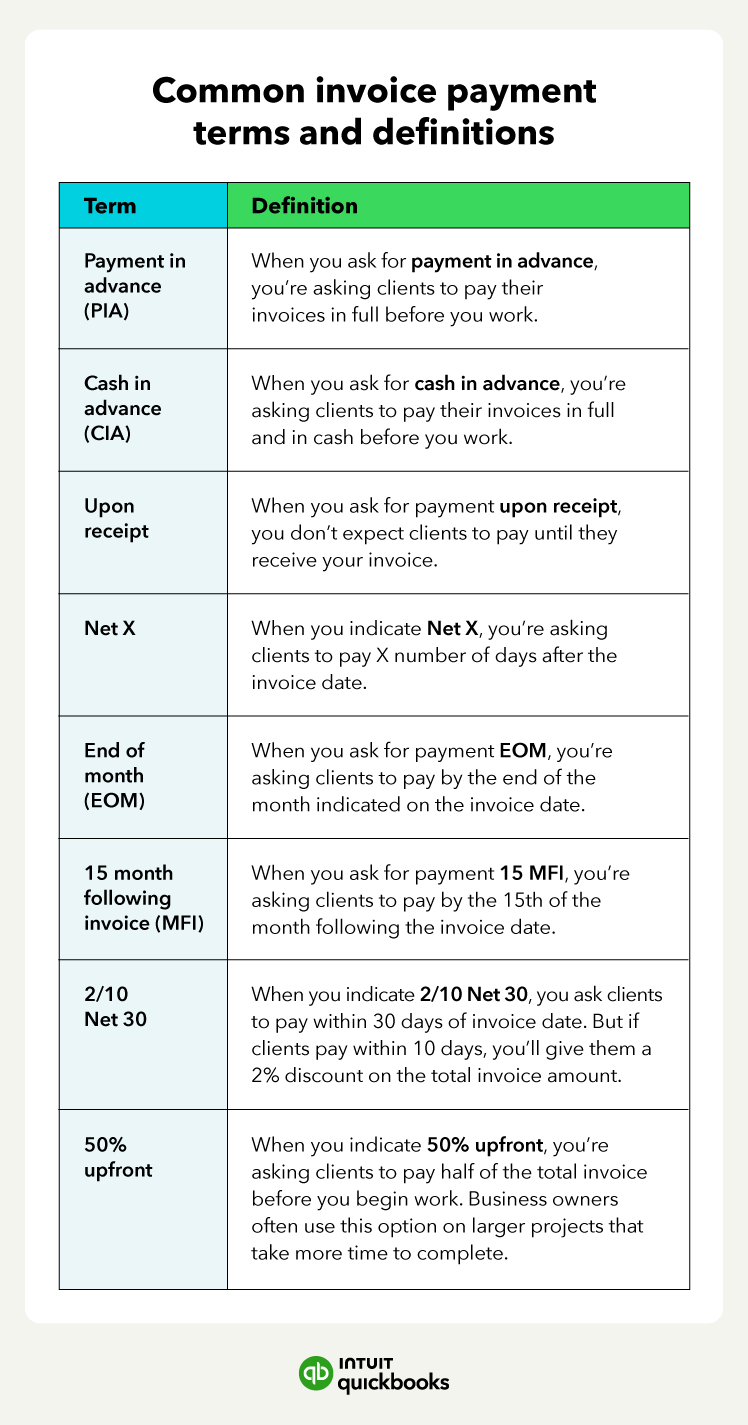

Start hereTo increase the likelihood of receiving payment on time, provide clear details about payment expectations. Your payment terms should specify the amount of time the buyer has to pay for the agreed-upon purchase.

Choose invoicing terms that encourage early payment to maximize your cash position and the likelihood of getting paid. You may choose to collect half of the payment upfront or partial payments over time or require immediate payment upon completion.

When setting payment terms, consider how to handle late payments. You might also consider a customer’s credit history when developing payment terms, particularly for large sales.

Then you can decide how long your customer needs to settle an invoice. Net 30 days (or “N/30″) is one of the most common terms of payment. It means that a buyer must settle their account within 30 days of the invoice date.

It’s important to remember that 30 days is not equivalent to one month. If your invoice is dated March 9, clients are responsible for submitting payment on or before April 8. Businesses may also set invoice terms to Net 60 or even Net 90, depending on their preferences and needs.

There are many different invoice payment terms, so it’s important to choose the right payment terms for your business. The chart below shows some of the common payment terms you may choose.

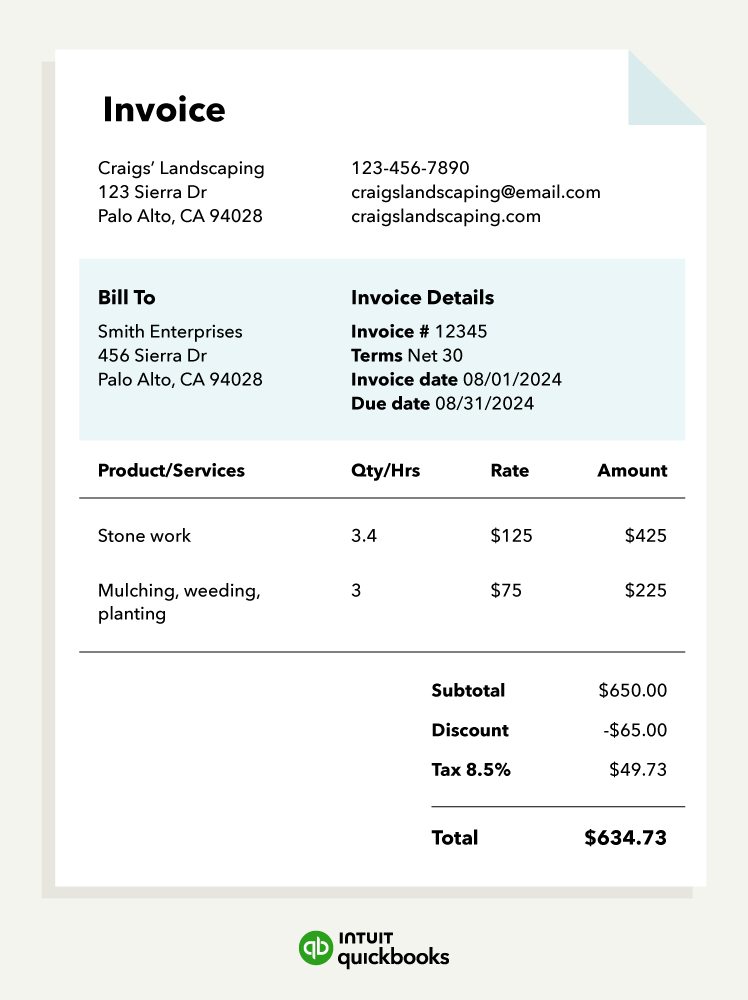

While invoices may vary by business, all typically follow the same structure. Here is how all of the above details come together into a sample invoice:

If you’re ready to create an invoice, QuickBooks offers many free, customizable invoice templates to help you create different types of invoices in a variety of file formats. Options include templates for pro forma invoices, freelancer invoices, service provider invoices, and more. Find a free invoice template that works for your business.

You can also use our free invoice generator tool to make and download custom invoices online.

Different types of invoices can be issued to customers depending on the purpose of the invoice. Here are a few of the most common types of invoices you may use during the payment process.

Also known as a standard invoice, a sales invoice documents the sale of goods or services and the expected payment amount, due date, and terms. Businesses in various industries use this versatile formal request for payment, and the sales invoice is the most basic form of invoicing.

Pro forma invoices are issued to a customer before a product or service is delivered. Businesses use pro forma invoices to help customers understand the scope and cost of an upcoming project.

Pro forma invoices are sent before a formal invoice is issued to give customers an estimate of how much a product or service will cost once delivered. The terms in a pro forma invoice may need to be adjusted as a project progresses, but they can be a helpful tool to ensure businesses and customers are on the same page before work begins.

Interim invoices are issued when a large project is billed across multiple payments. Businesses use interim invoices to collect progress payments before a project is completed.

Interim invoices can help businesses manage cash flow by allowing them to collect payments throughout the project and cover associated costs as work is completed, instead of waiting until the project is done.

Recurring invoices are issued to collect recurring payments from customers. Typically, recurring invoices are issued throughout an ongoing project. For example, a marketing agency may issue recurring invoices to clients every month to bill for services provided.

If a business bills a client for the same amount on a recurring basis, automating your invoices can reduce some of the work associated with creating and sending invoices.

A credit invoice is issued when a business needs to provide a customer with a refund or discount. The invoice will include a negative amount to cover the cost of the amount returned to the customer. If you overbill a client for services, you can issue a credit invoice for the amount overbilled. This invoice provides documentation of the amount you’re refunding to the customer.

A debit invoice is issued when a business needs to increase the amount a client owes for a service or product. For example, if you underbilled a client for services, the scope of a project increased, or you worked additional hours on a project after sending an invoice, you can issue a debit invoice to account for the difference.

Commercial invoices are customs documents used when a person or business is exporting goods internationally. The information included in commercial invoices is used to calculate tariffs.

There is no standard format for commercial invoices, but some specific pieces of information are required:

Typically sent at the end of a project, the final invoice documents that the business has upheld its end of the deal and payment is due. This kind of invoice can follow after an initial pro forma or interim invoice to inform the customer that payment is required.

A past due or overdue invoice is an unpaid invoice past its due date. When an invoice is past due, your customer or client hasn’t paid you according to the agreed payment terms.

Past due invoices can impact cash flow, and collecting overdue invoices can cost business owners time and energy. Writing clear invoices that are easy to understand may help reduce the risk of an invoice being past due.

Offering a variety of payment options may also help reduce overdue invoices. Business owners may consider using pay-enabled invoices that allow customers to pay their bills directly from the online invoice

As you create an invoice, keep these tips in mind to ensure both parties are clear on payment expectations.

If you own a service-based business, include the title of your project, as well as a description of the activities you perform. If you’re selling a range of products, include your SKU or product ID in the itemized list on your invoice.

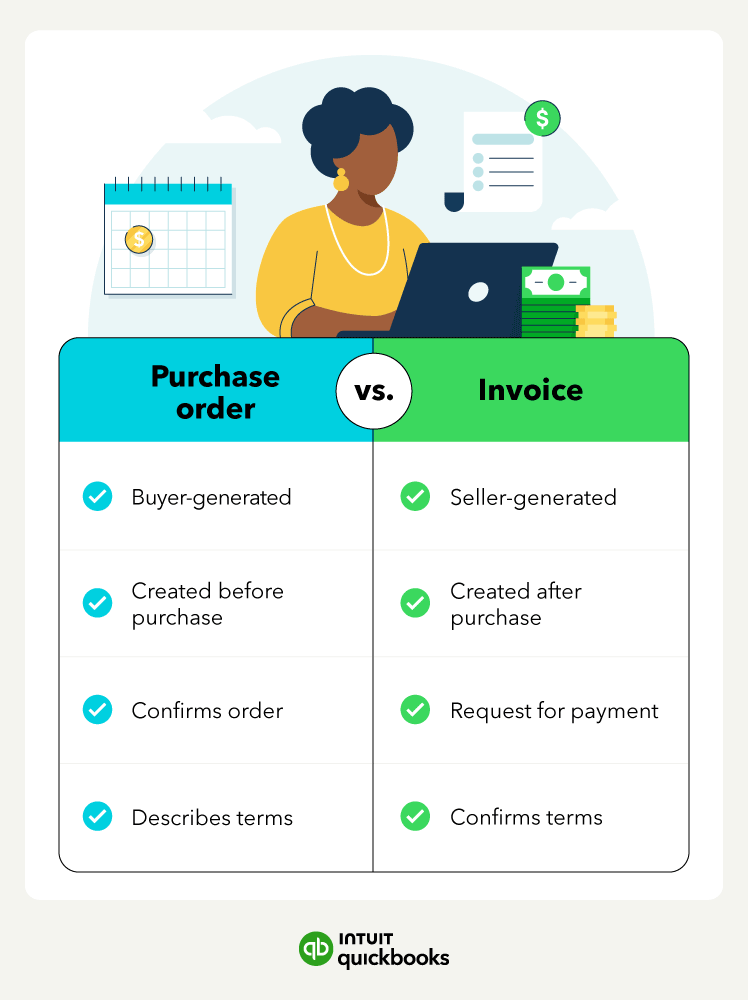

2. Differentiate purchase orders and invoices

Invoices are sometimes confused with purchase orders, but these documents serve different purposes.

In general, sellers issue invoices, and buyers issue purchase orders (PO). A purchase order is a purchase contract between a buyer and a seller.

If a local coffee shop wants to buy five cases of espresso from their favorite distributor, the owner might sign a purchase order when they buy the product. The distributor will issue an invoice upon receipt of the coffee

To streamline your invoicing efforts, make the payment process easy. Provide customers with an easy way to pay your invoice to encourage on-time payments and improve their experience with your company. Using QuickBooks, you can create electronic invoices and accept payments from one location, improving the overall transaction for your team and your clients.

Automating your invoice process can streamline your accounting operations and simplify your bookkeeping. When relevant to your business, take advantage of recurring invoices to encourage continuous cash flow.

How you approach incentivizing on-time or early payments depends on your business, but encouraging customers to pay promptly can save you time and money. Alternatively, if a customer fails to pay their invoice and receives ongoing or recurring goods or services, pausing work until you receive payment may incentivize action.

Invoices are more than just a simple bill or receipt. So, what is an invoice? Invoices are essential tools that business owners can use to keep accurate sales records, create paper trails, and ensure prompt payment in full from customers.

With our accounting software , you can easily accept payments, send custom invoices, and take advantage of automatic matching to streamline your bookkeeping. Financial statements update in real-time, immediately reflecting shifts in your accounts receivable and bank account balances.

By crafting clear, informative invoices and following a standardized invoicing process with our automated technology, you can increase the likelihood of getting paid on time every time.

An invoice is a formal document businesses use to request payment for goods and services. Businesses invoice customers by sending a physical or digital invoice document outlining information, including the products or services delivered, the total amount due from the customer, and the expected due date of the customer’s payment.

Is an invoice a bill?Invoices are not bills , though they share similarities. Invoices document sales transactions and are used to request payment for goods or services with specific terms outlined regarding the amount, transaction method, and due date. Comparatively, a bill is a document of sale requesting immediate payment upon receipt, and bills contain less information than an invoice.

When should invoices be issued?Create and send an invoice as soon as you complete an order or service a. Failing to invoice clients quickly can lead to delayed payments. Timely invoicing can help you improve cash flow. Using metrics like days sales outstanding (DSO) and the accounts receivable turnover ratio can help you keep track of payment speed and your accounts receivable efficiency.

Are invoices legal documents?No, invoices are not legally binding documents on their own. Invoices do not contain proof that a business and its customer have agreed to the terms of payment outlined in the invoice.

To reduce the chances of a disputed invoice , businesses may create contracts that outline the details of a transaction. Contracts signed by both parties can act as legal documents, reduce the chance of misunderstandings about transactions, and help speed up the payment process.

How long should you give someone to pay an invoice?Net 30, or 30 days, is a common amount of time given to pay an invoice , but you should choose payment terms that make sense for your business, your customer, and the transaction. Define clear payment terms that outline how long customers have to pay their invoices during the sales process.

Options range from requiring payment in advance to net 90 terms, giving customers 90 days to pay outstanding invoices. The cost and complexity of a project may factor into the payment terms you choose.

What is an invoice payment?Invoice payments are when a customer completes a scheduled payment for products or services they received as outlined on an invoice.

What happens when a customer refuses to pay an invoice?Customers may disagree with an invoice you’ve issued. When this happens, you’ll need to begin resolving the invoice dispute, starting with a conversation between you and the customer to determine which elements of the invoice the customer disagrees with.

Some disputes can be resolved through discussion. If you and your customer can’t reach an agreement, you may need to escalate the situation and take legal action to collect payments.

In other cases, customers may not have an issue with the invoice but rather simply haven’t paid the invoice according to the agreed payment terms. In this situation, contact your customer about the unpaid invoice as soon as possible. If your attempts to collect payment aren’t successful, you have a few options, such as invoice factoring or taking legal action.

Letting customers know you offer discounts for early payments or charge late fees on overdue invoices may encourage them to make timely payments.

Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor's degree in finance from Appalachian State University.

Image Alt Text" />

Image Alt Text" />

Image Alt Text" />

Image Alt Text" />

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.